Solar for Residential Tenants and Landlords

When solar power is installed on a residential property where the owner resides, they will directly benefit from reduced energy bills.

That’s great for homeowners, but what about tenants, how can they benefit? And what incentive is there for a landlord to install solar on a rental property?

A proposed solar power installation on a rental property must provide benefits for both the tenant and landlord to make it worthwhile.

For a rental property owner to invest in a solar power system, they would need to achieve a return that justifies the financial outlay required. In most situations, to accomplish this, they would need to increase the rent accordingly.

To accept a rental increase due to the addition of solar power, a tenant would need the incentive of receiving a benefit that is at least equal to the rental increase.

As an example, if a landlord requires $12 per week additional rent to install solar, then the solar power system would need to provide around $30 per week savings – thus providing the tenant with a net benefit of $17 per week.

In this region, a rental property return on investment in the range of 5% – 6% is considered good.

A 8% return would be considered a premium investment property.

Using the above example of $12 per week, this would be an additional $624 per annum from the rental increase.

If calculating for a 8% p/a return for the property owner, this equates to an investment amount of $7800.

$7800 will purchase a solar power system with high-performance panels that can generate around 145 kWh per week (averaged across 12 months of seasonal variance).

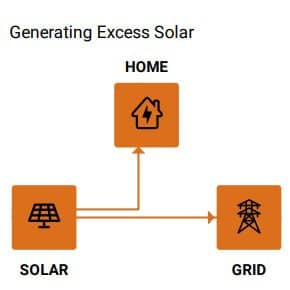

The solar power supplied by the system will be used in two ways:

- consumed directly to supply electricity used within the property – offsetting the cost of electricity which would have otherwise been purchased (imported) from the grid.

- surplus electricity production will be sold (exported) to the grid – the electricity account receives credit for exported power.

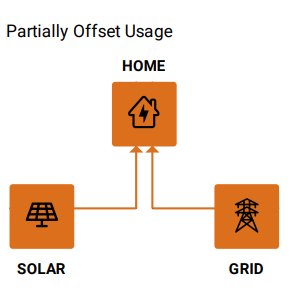

The ratio of directly consumed and exported solar production will vary due to several factors, such as:

- seasonal variations in energy production & consumption

- the electrical appliances in use (heating/cooling, pool pumps, etc)

- whether people are home during the day

- the solar system output capacity relative to average energy usage

The percentage of total solar production that is used directly in the home as it is generated is often referred to as solar self-consumption rate.

Consider the following scenario:

For a system producing an average of 145 kWh per week, with a 40% self-consumption rate [40% of solar production (58 kWh) used directly by appliances and 60% (87 kWh) exported to the grid] the benefit can be calculated as shown below.

Using a reference price of 45c/kWh and a feed-in tariff rate of 7c/kWh, the benefit would be:

(58 kWh x $0.45) = $26.10 (energy off-set/not purchased from grid)

+

(87 kWh x $0.07) = $6.09 (energy sold to the grid)

=

$32.19 per week.

After subtracting the $12 extra rent, the tenant would be ahead by $17.19 per week ($894 per annum).

So, the numbers stack up & everyone wins. The tenant is $17 per week better off, and the landlord achieves a 8% p/a return.

Property owners:

To maintain a good return on investment, most Landlords are aware that a well presented and maintained property will attract good tenants who stay for longer periods, and generally attract a premium rent.

The provision of solar power to help tenants reduce energy costs will have a similar result, while also enhancing the property value.

Tenants:

If you would like to find out more about how you can reduce your energy costs with solar, give us a call or complete the enquiry form below. We provide an electricity bill and property assessment, and prepare a solar proposal for you to discuss with your Landlord.

Request a Quote

“At SolarWise Wagga our philosophy is simple, we aim to provide relevant and reliable information, quality service, and the highest grade of products at a competitive price.”

Request a free Quote today!